China’s wine imports continue to drop in Q1 2022. The news shakes the industrial professionals although, we have prepared for it by acknowledging the “zero covid policy” in China. However, how does the wine market in China look exactly?

The explanation is divided into two different parts.

On one side, there is the traditional wine merchandise industry in China. There are importers, regional distributors, on-trade and off-trade players, and consumers. The roles can be shared and switched if the effort and ROI are reasonable. We shall notice that a lot of premium wine and winery wine is circulated in this sector.

On the other side, China’s vast e-commerce landscape has its marketplace for wine. The e-commerce environment forces more transparent pricing. The packaging and celebrity endorsement strategy is quite intense. The reward is the huge volume and fast turnover. What type of wine producer is capable of it?

The unmatching fact

For many European wine producers, either side looks “friendly”. Many are medium-range premium wine producers. They produce quality and unique wine from its terroir with more artisan involvement. Production is small to medium. Pricing is on the medium+ level in the domestic market. But, it becomes medium/high in China. The wineries value more the quality but can be weaker in front of their very commercialized competitors.

Therefore, is there space for the wine market in China for those smaller producers?

Yes, you do.

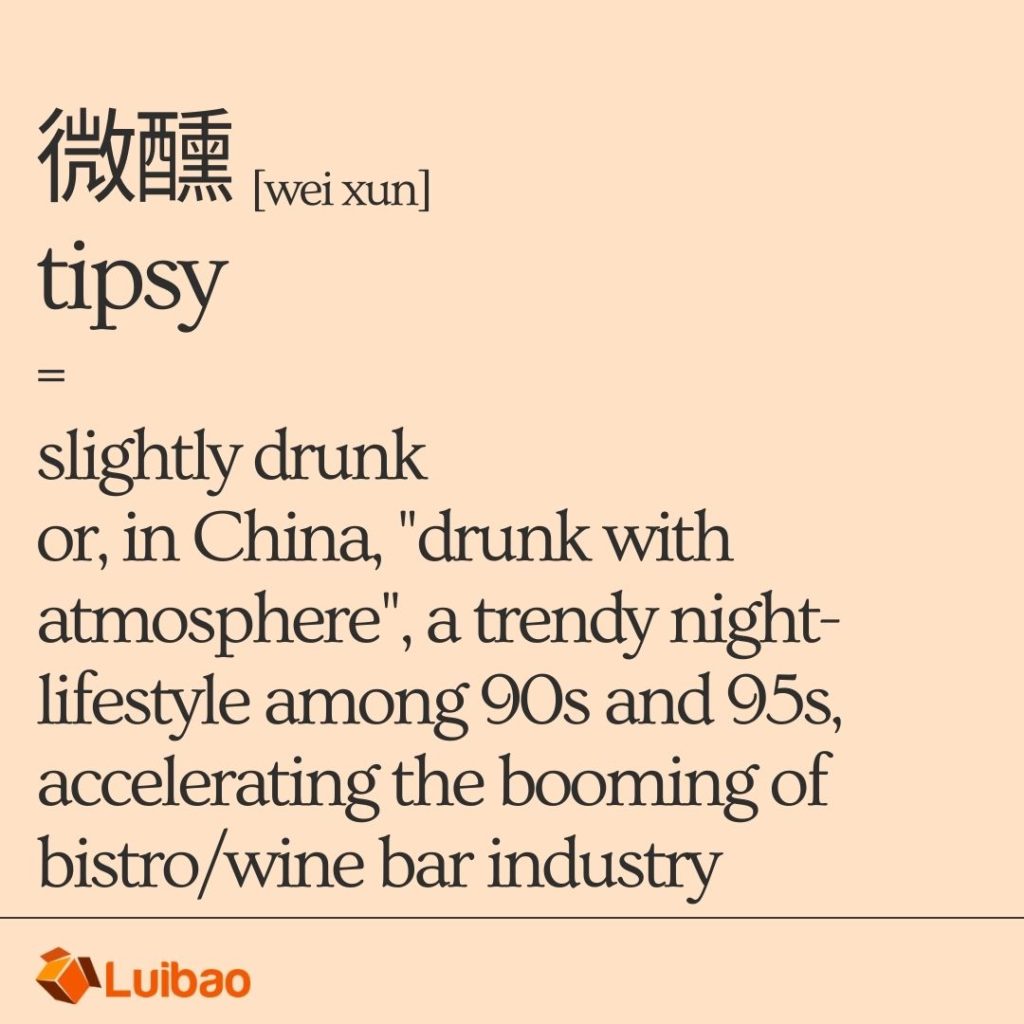

The booming bistro industry, together with the “Wei-Xun” (Tipsy) trend among young consumers is one fraction of the wine market in China.

The values for China’s new wine market segment?

The new consumer generation in China might not judge a bottle of wine heavily on its brand and ranking accordingly to the traditional wine classification.

However, they are looking for the values like,

- brand story and winemaking philosophy,

- taste and quality,

- label design and packaging (catering to new consumers’ value),

- pricing (always…).

What does the bistro business, that possible fraction of the wine market in China look like?

Bistro in China, you can also call it, Tavern.

The concept of it is the same as the bistro you know everywhere else in the West. It is a place heavily dependent on nightlife and social life culture. Alcoholic drinks and small bites are often available. Some even have entertaining facilities, such as darts in a sports bar, or a live band in a music bar.

What is the size of the bistro business in China?

This history of modern bistro business in China started in the late 90s to 2000.

An example, Helen’s Bar

In 2009, Helen’s Bar started a down-to-earth bistro offering value-for-money menus, targeting university students and young consumers. Over the next 12 years, Helen’s expanded at an impressive speed with a franchising model. 2021, it went for IPO.

Between 2014 to 2020 (pre-COVID), there is a fast development of the premium bistro businesses in the top-, first-, and second-tier cities in China. Until the end of 2021, 14,658 bistro businesses are registered. Competition has increased over the years, meanwhile, the average industry standard is pushed up as well.

As iiMedia research, the market size of this niche reached about 128.04Bn RMB (USD19.37Bn) in 2021. As the expectation, this number will continue rising and reach 148.78Bn RMB (USD22.51Bn) by the end of 2023.

What is attractive in bistros to the Chinese young consumers?

As data shows, the nightlife economy is closely linked to the Chinese young consumers. More than 23.5% of young Chinese hang out at bistros at the night, after cinema (52.6%), dine-out (37.5%), fitness (34.7%), and KTV (33%).

For what reason, do those consumers visit bistros in China?

Relaxing and relieving stress from daily work-life ranks at the top.

57.5% of bistro consumers hang out in a group of 2 to 4 persons. 31.4% of those hang out at bistros with only one friend. The relationship among the bistro consumers is normally private friends, colleagues, and class/schoolmates.

The relaxing and comparably quiet environment of a bistro is what those consumers are looking for.

What is the behavior of a bistro consumer in China?

According to the breakdown data, more than 60% of Chinese bistro consumers hang out at local bistros at least once a month. Almost 20% of those visit bistros once a week.

71.6% of the bistro consumers spend between 100 to 300 RMB (USD15-45).

In the research, 59.7% of Chinese bistro consumers consider the atmosphere of a bistro the most important factor. Almost half evaluate the pricing, bistro design, and popularity/reputation.

Regarding the population and reputation, content model social media (45.5%) is the top channel where the bistro consumers acquire the information. This also matches the behavior of Chinese young consumers nowadays.

What does the industrial professional say?

“The young consumers (90s) are very curious about wine and are willing to try and to learn about the winemaker, the winery, and the wine itself. However, they enjoy a glass of wine as part of their lifestyle only. Compared to the traditional wine drinkers, they are not willing to spend much time and effort studying the complicated wine knowledge to drink wine. They are looking for a connection from the wine to their personality or lifestyle.”

By the owner of a major premium and natural wine import company in China.

To summarize, the wine market in China has passed its golden age a long time ago. The market is becoming more mature, as well as the consumers. Meanwhile, we see Chinese young consumers taking over the market and pushing the industrial players to stay active and creative all the time. China market is highly segmented, not only geographically but also according to the consumer profiles. Small-to-medium wine producers, never stand side-by-side next to the big guys, but target the correct niche channel, which isn’t “niche” if you consider the overall market size in China. The key is to present the correct products with the correct values to the correct counterparties.

Reference: