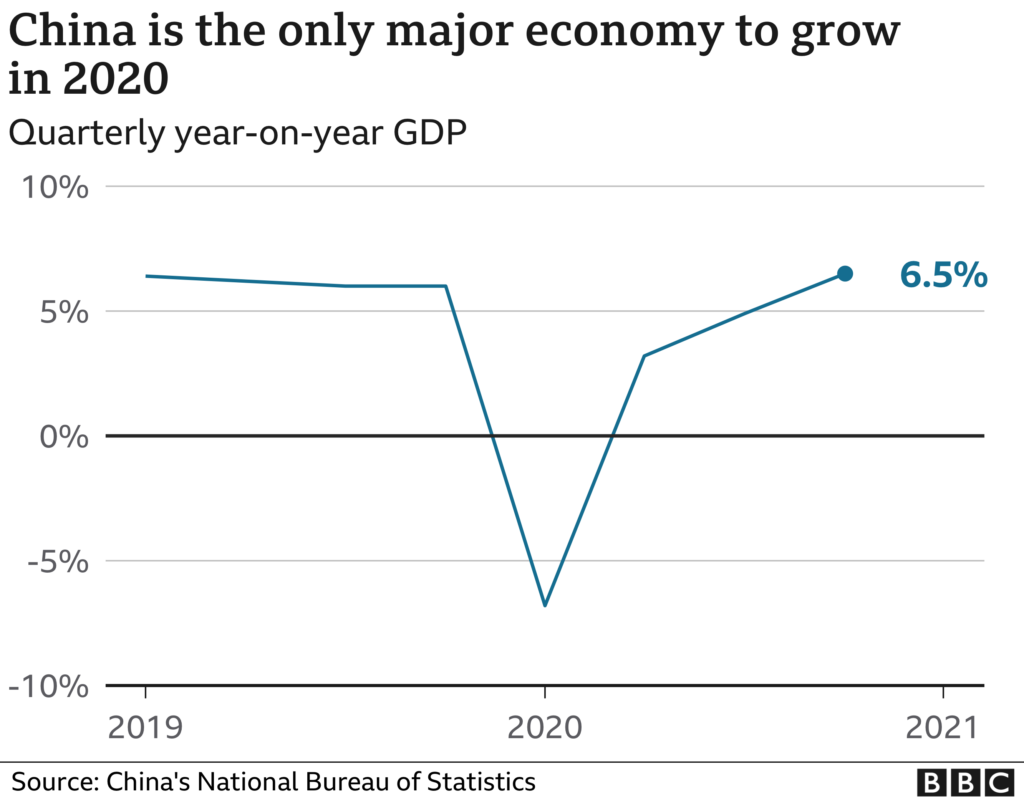

“China is the only major economy with a positive figure after 2020’s COVID-19 pandemic.” This headline hit many major news platforms in the last quarter of 2020. How did China do business in the post-covid period? How did they pick up the growth to 6.5% in the final three months of the year?

However, when we look at the positive number that China made in 2020, we shall also pay attention to the negative ones.

For example, there was a clear drop in the first quarter of 2020. China’s economy grew only 2.3% last year, and that is the slowest pace in more than four decades, according to BBC. As the report by Ali research Center, in 2020 Q1, 460,000 Chinese companies closed their business due to COVID-19. The small-to-medium manufacturers, which contributes 62% of China’s GDP, were hit hard.

After almost a year, China’s anti-COVID policy is not yet loosening. This puts a long-term shadow on many traditional businesses. Many traditional shopping environments like shopping malls and supermarkets couldn’t react fast enough to their loss.

You might see most of them did develop their online presence. However, many failed to go fully ready for a thoughtful online strategy. They didn’t invest in developing the real online-to-offline ecosystem. The precious offline data wasn’t well collected. Neither was the online data well analyzed. Indeed, they might not have a professional team either.

After a year, we have already seen the changes of doing business in China for the post-COVID period.

More traditional businesses are seeking a change, going online, and embracing the mindset and strategy of doing business in China based on the Internet, the data, and social media.

The biggest phenomenons

O2O (online-to-offline) model has shown its great advantages when dealing with the impact and restriction from COVID-19.

When the Chinese consumers of all age groups are staying and shopping from home, O2O businesses offering many daily consumer products quickly took over the market, and even won over an impressive new client base.

One example is China’s silver-hair generation. Before COVID-19, shopping in neighborhood supermarkets and nearby shopping malls are still the first choice due to this generation’s shopping habit. However, since COVID-19, they turned to shop for fresh food and many other daily products from O2O platforms.

To grab those new shoppers, the O2O platforms with brands gave away promotional discounts and coupons, leveraged Zhibo (live streaming) for a better and direct shopping experience, and invested in silver-hair influencers. Many of the new shoppers do stay in the post-COVID period.

Currently, the Ecommerce spend of silver-hair generation is around 15% to 20% – Yet, large space to grow.

When talking about China’s Internet business, consumer market, and social commerce environment, it is easy for us to forget the invisible influence from the China government.

The second phenomenon of the post-COVID period is the big adaption of community-based service.

Health service, public service, and the public education are all boosted now.

A good online community service network not only benefits the public sector, but also the private one. Many public health, education, community-based services are catching up with their new business strategy by reaching their clients subjectively and seamlessly.

Eleme and Mei Tuan started as the platforms for food delivery. COVID made them deliver freshly picked and shopped food from the market to the user.

Tao Xian Da, as one of the many sub-businesses of Ali Group, worked with supermarket brands and fresh food chain shops directly for the online-to-offline service.

Instead of retaliatory consumption in the post-COVID period, we expect rational consumption in China

The bloom of Ecommerce is like a strong dose for the Chinese consumers. In the past 5-10 years, we see a nearly crazy growth in consumer spending power. The growth is not only in the way of volume, but also the unit price per SKU.

However, COVID pulled the Chinese consumers in 2020. In the post-COVID period, Chinese consumers are calmer and more rational. It might mean a decrease in impulsive shopping and over-shopping. However, we think the Chinese consumers are more willing to pay for good values now.

Value for money

If you talk about “value for money” 10 or 20 years before, it means very likely “lower price”. Now, it means “right price” – according to the brand value, the product value, and the market value.

The brand value and the product value largely depend on how to deliver the values to the target clients. But, here, we want to focus on explaining the market value.

Market value means the trends in your niche industry and the expectation of your target clients. Understanding what is trendy, who are your target clients, and what are they expecting from a brand like you, affects the decision of what kind of brand value and product value you want to highlight in your communication, and in which way to communicate.

Hey Tea, as the top bubble tea brand in China, launched its sugar-free sparkling water in the summer of 2020. An impressive sale of 300,000 bottles in one night, was created by Hey Tea and the top Zhibo influencer, Viya.

The brand wins great reputation by the fresh ingredients, AKA. the quality and smart marketing strategies like cross-branding and content marketing among young consumers. This time, it expands to the healthy soda drink field.

Sugar-free is the product value that perfectly matches the booming demand from the Chinese consumers. The brand, Hey Tea, has its value related to good quality over the years. However, Hey Tea knew Viya is equally important in terms of delivering the values.

Value from the changing perception

Let’s directly dive into the example.

Health was a trend in China. It is now, and it will be still in the future. So, what is the difference between the past to nowadays?

Answer: The perception.

Health in the past means when you are sick, you go to the hospital and a doctor. Then, you get better if nothing is too serious. Or, you need something more, if you are not lucky.

Health now in China means a healthy diet (considering supplements also), healthy lifestyle, taking good care of yourself and your family (including your pets), visiting your home-doctor or going for medical service for regular check… the list continues.

Let’s see the numbers.

In 2020, the total sales value of the drink category in China fell by 1.6% comparing the year before. However, the sub-category, healthy soda drinks, achieved an impressive 16% increase.

Yuanqisenlin is the black horse in this category. The sales reached more than $123Mn and the major features of its products are sugar-free and sparkling. You might ask, “That’s it?” Yes and no. Surely, the brand knows much more about how to do business in China.

So, how to do business in China in the post-COVID period?

Preparing for the online business environment is the undeniable approach

If you are in the field of traditional offline business, considering the collaboration with O2O platforms or channels to fill the gap. The platforms in China can be eCommerce like Taobao, Tmall, JD, Pinduoduo. The channels can be HeMa and Tao Xian Da by Ali Group, Ele Me, Mei Tuan, and many more. Companies also consider their own mobile Apps or mini-programs on WeChat.

Investing in the community and private traffic management

Location-based community service is the one aspect closely linked with O2O business. From 2019 to 2020, we see a 55% increase in sales in the fast consumer market by O2O. You are serving and building a strong relationship with your neighborhood clients through online platforms. The win? They always come back to you.

It is not the first time we talk about private traffic. Good management of your private traffic means higher retention with a lower cost.

Take Hey Tea’s figure in May 2020, 80% of its shop orders are from mini-program. Membership registration was more than 26Mn and the repurchase rate was more than 300%.

Think about the groups on your Chinese social media (eg.WeChat), the mini-programs on WeChat, and the mobile Apps. They are where your private traffic is.

Embrace the “shoppertaining” trend is you do business in china not only for post-covid

Shopping is not just shopping for the Chinese. It is also an entertaining and time-killing thing.

There are games, Zhibo (live streaming), virtual experiences to enrich a shopper’s instant experience. The latter two options also fill up the shoppers’ experiencing needs during COVID lockdown.

Prepare for the automation in the post-covid period

COVID is influencing our habits and reshaping the world we are used to. We expect to see more automation in the normal daily lives.

For example, the self-pick-up lockers will be much more in the post-COVID period. It was there before COVID, but it seemed the Chinese still preferred the people-to-people experience. However, in the post-COVID, we expect more Chinese will change their preference.

In this case, should you reconsider the packaging of your products? Whether it has easy access to automation practice in China?

how to do business in china in the post-covid – “Getting together”

Whatever doing business with Tmall, JD, or WeChat, your business is collaborating with at least one giant Chinese platform.

We think in the post-COVID period, the “getting together” practice between the brands and the platforms will be more. The platforms, in the front, are your marketplace to individual clients. Behind it, it is an all-around supply chain environment. Some of the platforms support product distribution too.

Reference:

Covid-19: China’s economy picks up, bucking global trend

Why is Yuanqisenlin popular in China?

Hey Tea launched sparkling water – sold 300,000 bottles in one night